Signal Over Noise

2025 was one of the most important periods in VTubing’s history not because of any single breakout star or controversy, but because it forced the industry to confront uncomfortable structural truths. Community sentiment, particularly on platforms like X, has increasingly framed VTubing as a space where corporations are losing relevance and indies are “winning.” That narrative is loud, emotionally charged, and largely misleading.

To understand where VTubing is actually heading in 2026, it’s necessary to separate noise from signal. Indie creators have gained cultural influence, but influence is not the same as control, sustainability, or scale. Meanwhile, the companies that truly matter, the ones shaping the long-term direction of the industry are being judged not by fans, but by capital markets.

The Reality of “Corpos”

The term “corpo” has lost analytical usefulness. In practice, there are only two genuine VTubing corporations: Hololive and Nijisanji (Though one could argue Brave Group). They are publicly traded, investor-facing companies operating at scale. Most other so-called agencies are undercapitalised micro-organisations, small teams with money and an idea, but without the professionalism, infrastructure, or long-term planning required to survive.

Lumping all of these entities together obscures what actually matters. If you want to understand the trajectory of VTubing as an industry rather than a fandom, Hololive and Nijisanji are the only meaningful reference points along with understanding the vast Indie sector.

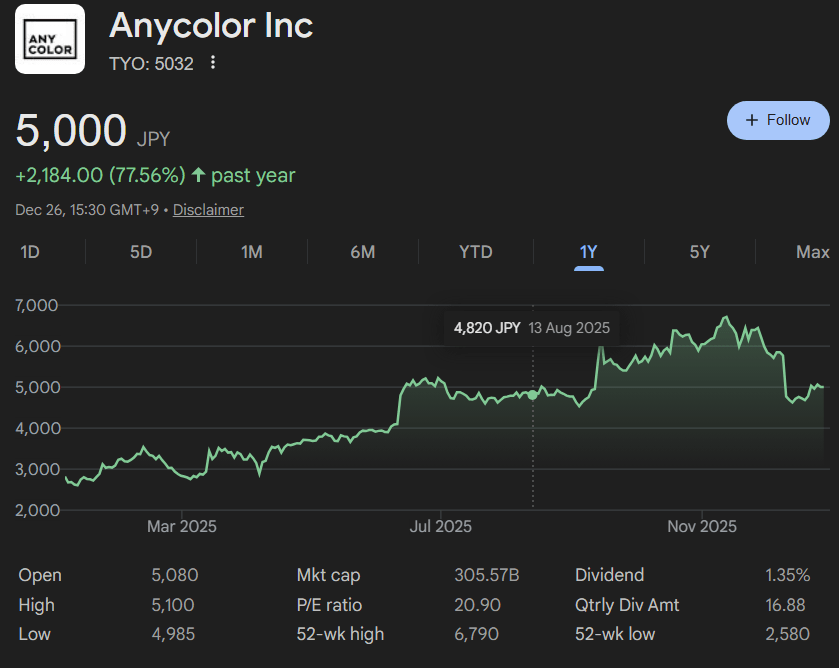

The Stock Market Has Spoken… Quietly

Over the past year, Nijisanji’s stock has risen dramatically while Hololive’s has fallen sharply. This divergence tells a story most of the English-speaking VTuber community has ignored.

From a Western perspective, Nijisanji appears damaged beyond repair. Trust collapsed after high-profile controversies, and the English-speaking community largely abandoned the brand. But that perception is not shared universally, and it is not shared by the market.

Japan remains the engine of the VTubing industry, culturally and commercially. Nijisanji has focused on repairing internal failures, investing in infrastructure and staff, and pushing further into the domestic mainstream. Investors rewarded that execution. The comeback is real, it’s simply happening outside the Western discourse.

Hololive, by contrast, still possesses the strongest IP in the industry. It avoided catastrophic PR crises even after losing major talents, and it remains the most recognisable brand in VTubing. But investors have lost confidence not in its popularity, but in its strategy.

The North America Problem

Hololive’s overreliance on North America has become a liability. Tariff pressures exposed how little contingency planning was in place for a company so dependent on that market. From an investor’s point of view, this was not unforeseeable bad luck, it was a failure to diversify.

Europe was available. Hololive had the strongest hand in the industry and the freedom to expand its IP geographically. Instead, it remained concentrated, and the market punished that hesitation.

VTubing’s Core Structural Flaw: The Live IP

Despite growing investor interest, VTubing still lacks a mature IP model. VTuber characters are not traditional Ips, they are live IPs.

A VTuber cannot be separated from the performer behind them. Unlike characters such as Mario or Pikachu, whose identities persist regardless of who voices them, a VTuber’s identity is inseparable from the individual operating the character. When that person graduates, the IP effectively dies.

This makes long-term value creation inherently fragile. Graduations are not moral failures or scandals; they are structural inevitabilities. The challenge for VTubing companies is not preventing them, but surviving them.

The Ecosystem Must Become the IP

If individual characters cannot last forever, the ecosystem must.

For VTubing to function as a true IP industry, companies must rotate talent aggressively and intentionally. There must always be a top generation carrying the brand, a middle generation growing into prominence, and a new generation developing beneath them. By the time a leading generation graduates, the next must already be capable of sustaining relevance.

This is far more demanding than traditional character IP management. Nintendo can rotate Mario, Peach, and Donkey Kong over decades. VTubing companies must do it in years and do it flawlessly.

Why Mainstream Integration Matters

Hardcore VTuber fandoms are passionate, but they are also volatile. Businesses built entirely around constant emotional engagement are fragile by definition yet that does not make hardcore fans disposable or unimportant.

These fans were instrumental in building VTubing into what it is today. They helped establish the IP, created the early momentum, and continue to provide a level of engagement no mainstream audience can replicate. They expect rewards for that loyalty, and rightly so.

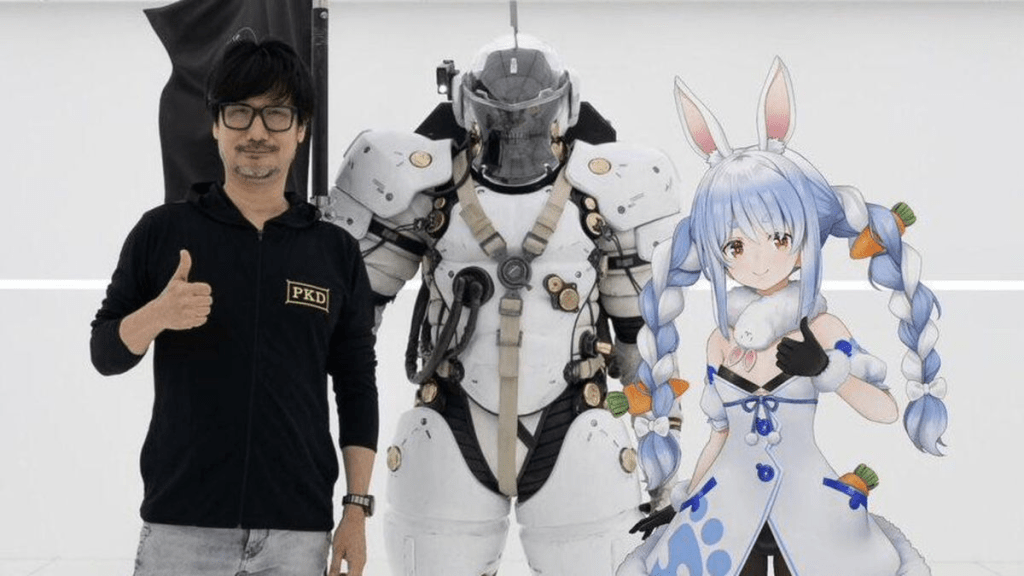

The risk lies not in satisfying hardcore fans, but in treating them as the sole engine of growth. Sustainable IP companies diversify their revenue and cultural presence so that they are not exposed to the emotional volatility of any single audience segment. Mainstream collaborations, video games, music, live events, and cross-industry partnerships must function independently of daily fandom sentiment.

Hololive’s high-profile cross-industry collaborations point in the right direction. Hardcore fans should be rewarded and retained, but they cannot be the only pillar holding the business up. Long-term growth depends on building structures that survive even when online sentiment turns hostile.

Predictions for 2026

Brave Group Runs Out of Road

Brave Group represents capital without direction. Despite significant assets, it has failed to translate funding into innovation or growth. Its strategy of acquiring multiple smaller agencies appears increasingly like an attempt to buy optionality rather than build a coherent vision.

By the end of 2026, Brave Group will either no longer exist in its current form or will have pivoted sharply away from its current model. The opportunity to become a publicly traded VTuber corporation has passed.

The Collapse of the Micro-Agency Middle

Most small VTuber agencies have no staying power. They lack the capital depth and institutional resilience to absorb talent churn or scale into meaningful IP ecosystems. The industry does not have room for a healthy middle tier. Attrition will continue.

Phase Connect’s Ceiling

Phase Connect has successfully captured a highly committed, insular audience and in doing so, has locked itself into a corner. Growth will stall, and resilience will not replace it.

A significant portion of its revenue relies on maintaining emotional goodwill, particularly through consumable products such as branded coffee. This makes the company unusually fragile. It does not need a scandal to decline; attrition alone is enough. A single major graduation or termination would expose how little buffer exists.

Hololive’s European Pivot

Hololive will begin visibly diversifying away from North America in 2026. Europe, likely London, represents the next strategic foothold. More importantly, Hololive will pursue mainstream cultural entry points rather than VTuber-adjacent collaborations.

This will alienate parts of the core VTuber fanbase. That trade-off is unavoidable. Long-term stability requires abandoning the idea that hardcore fans alone can sustain a global IP.

Nijisanji Stays Japan-First

Nijisanji will not meaningfully re-enter the English-speaking market. The hostility is entrenched, the upside limited, and Japan remains the true centre of gravity. From a business perspective, this is the rational choice even if it remains unpopular in the West.

The Indie Bubble

The indie VTuber scene will continue to grow numerically, but not structurally. More creators, more platforms, more support services and more dilution.

Without shared infrastructure or capital, no single indie or small collective can host large-scale events or break meaningfully into the mainstream. The fandom itself has become increasingly inward facing, resisting interaction with other communities. This insularity stunts growth.

By 2026, the indie scene will resemble a bubble: active, crowded, and culturally loud, but unable to generate sustained breakthroughs.

Conclusion: Growth Without Direction

VTubing is not shrinking, it is expanding.

By 2026, the industry will almost certainly be larger in raw terms: more viewers, more creators, more agencies, more platforms, and more money flowing through the ecosystem. But that growth will be increasingly diluted. Audiences will be spread thinner across a greater number of talents and smaller organizations, while the number of players competing to capture that attention continues to rise.

This creates a paradox. As the industry grows, the ability to build durable value becomes harder. Volatility increases. Individual careers become more fragile. Small agencies and businesses struggle to convert attention into long-term stability. Growth, without structure, amplifies risk rather than reducing it.

The central question for VTubing’s next phase is not whether it will grow, but who will take responsibility for directing that growth.

In theory, that role should belong to Hololive. It has the strongest IP, the most recognizable brand, and the clearest pathway to mainstream legitimacy. If Hololive can stabilize its internal strategy, diversify geographically, and successfully transition into a true IP-led company, it could provide the structural gravity the industry currently lacks.

If it does not, VTubing will still grow but without coordination, coherence, or leadership. The result will be a larger, louder, and more fragmented ecosystem where opportunity exists everywhere, but durability exists almost nowhere.

Growth alone is not maturity. Direction is.